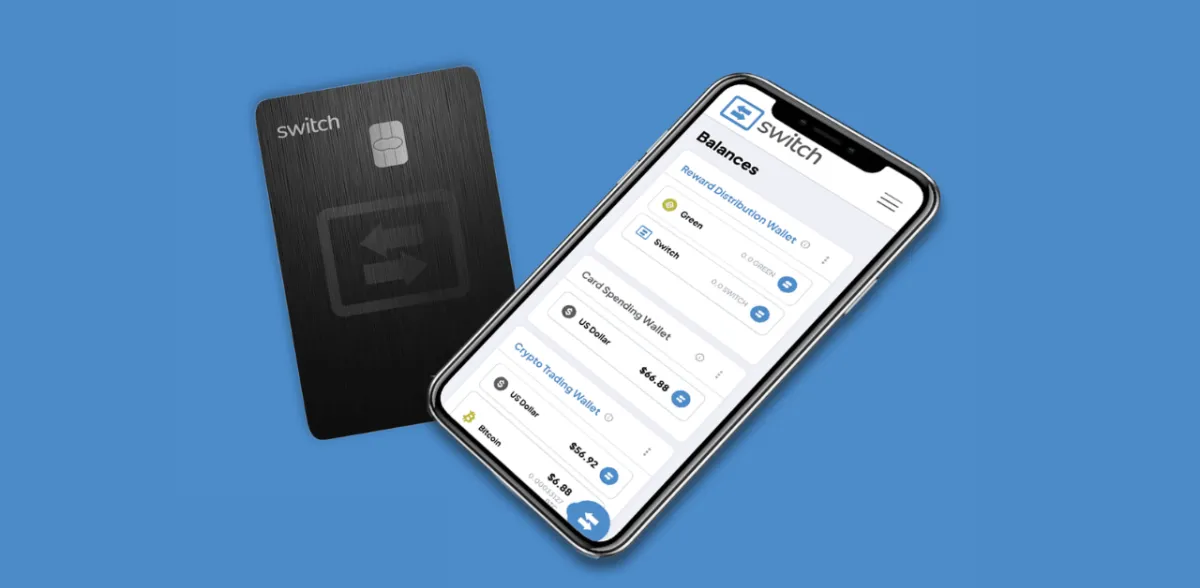

VISA DEBIT CARD

Spend Your Crypto Anywhere Visa Is Accepted

The Switch Card is a Visa debit card that lets you easily spend converted cryptocurrencies at any merchant worldwide. No staking or security deposit required.

Compatible with Apple Pay & Google Pay

Physical and digital card options available

Load funds from your Switch Wallet